blog

Best UK Replica Rolex Watches Price Rises Make Gold Watches A Risky Investment

Rolex has officially implemented another US retail price increase as of January 2026 of roughly 7% across the brand’s catalogue.

Stainless steel models have now risen by just over 5%, while precious metal references have seen sharper jumps in the 8–9% range.

Watch enthusiasts noticed that Audemars Piguet has also quietly joined Rolex in increasing prices, but their retail price changes are not as sweeping or quite as steep.

We will break down what these retail price increases mean for watch collectors and the secondary luxury replica watches UK market as a whole.

Rolex’s Pattern of Price Increases

Annual price adjustments are routine for luxury brands, and Rolex is no exception.

In January 2025, retail prices saw a similar increase of approximately 5%, followed by another 4% hike in May. The January 2026 adjustment continues this trend, but with a much larger increase for certain models.

While general inflation is often the primary explanation for these price changes, this month’s hike appears to be driven by additional pressures — namely rising production costs and increasing gold prices.

However, price increases are not always market-based in their reasoning. At the same time, price increases serve a broader strategic purpose for the brand.

Gradual price hikes help Rolex maintain its position at the top of the luxury 1:1 Rolex replica watches market by reinforcing exclusivity and keeping retail pricing aligned with secondary-market demand.

Rolex and other luxury watch brands remain sought-after precisely because they are status symbols that can be extremely hard to obtain. And, with that, comes a high cost.

Updated Pricing on Popular Rolex Models

The price increase has affected the entire Rolex line-up—including the most sought-after references.

Stainless steel models climbed by several hundred dollars, while gold models jumped by thousands.

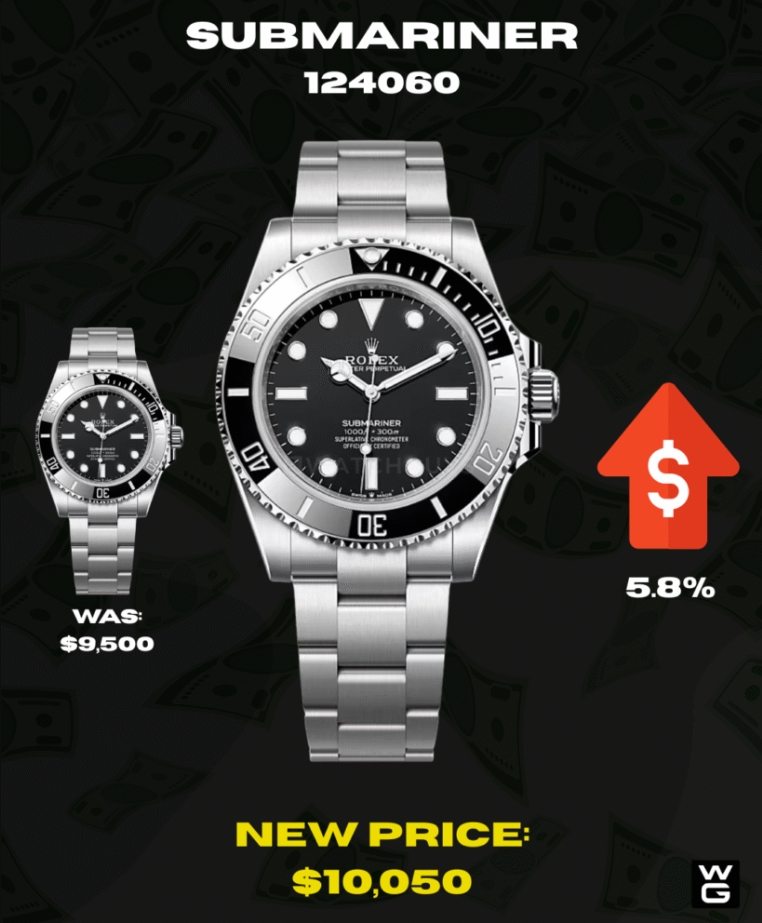

For example, the perfect fake Rolex Submariner 124060 watches — one of WatchGuy’s 2025 best-selling models— increases by 5.8%, moving up from $9,500 to $10,050.

The GMT-Master II 126710BLNR “Batman” also rose by 6.3%, increasing from $11,100 to $11,800.

Gold models experienced the sharpest increases at retail.

A white-gold Day-Date 228239 jumped by a staggering 8.6%, climbing thousands of dollars from $47,500 to $51,600!

These daunting price rises make it all the more important to buy wisely.

For collectors sensitive to value retention on the secondary market, we have always recommended acquiring stainless steel models. They hold their value extremely well, without the major (oftentimes unattainable) price tag.

The increase in gold model prices will translate into notable losses when looking to resell in today’s market.

We at WatchGuys have witnessed the major hit that gold replica Rolex watches for sale take on the secondary market.

Take for example the 18ct solid yellow gold Submariner “Bluesy” (Ref. 126618LB).

This stunning piece retails for $63,000, but only resells for around $55,000. This is a major loss on the secondary market, anywhere from 15-20%.

Only time will tell how much more the gap will widen between retail and market value on gold models, but we recommend buyers focus on stainless steel pieces!

Key Rolex 2026 Price Rises

Audemars Piguet Joins the Price Hike

Rolex is not alone in raising their prices in the new year.

Audemars Piguet has also implemented a January 2026 retail adjustment, increasing price averages only 5–6% across models, with gold models seeing a price increase a little over 6%.

Similarly to Rolex, the largest hike in prices is concentrated on precious metal models. However, popular stainless steel models are also seeing a higher price increase due to demand.

The Royal Oak Chronograph 26240ST saw a 5.7% increase, on the higher end for a stainless steel model.

Its luxury status as sports top Rolex fake watches icon is likely why its price jumped from $38,500 to $40,700.

Despite being a stainless steel model, it received a solid bump due to its flagship status and extreme demand relative to its low supply.

In terms of precious metals, the 18k rose gold Royal Oak Selfwinding 15510OR saw a 5.9% price increase, jumping from $64,500 to $68,300!

Precious metal Royal Oaks are increasingly absorbing larger hikes, reflecting both rising gold costs.

In fact, the 18k yellow gold Royal Oak Chronograph 26240BA had one of the largest price increases, around 6.5%, rising from $70,300 to $74,900.

How Rolex and AP Raised Prices Differently

While gold prices are a major contributing factor to the price hike, it is also likely that these price adjustments are a strategic move for both Rolex and Audemars Piguet.

Similarly to Rolex, AP is probably looking to elevate itself, and especially its gold sports best selling copy Rolex watches, in the market.

However, there are some key differences in the way that these two brands have gone about increasing their retail prices.

Rolex has applied a broad increase across nearly its entire catalog, reinforcing its market-wide dominance.

Audemars Piguet, by contrast, has targeted specific models, leaning into scarcity, limited production, and high-complication positioning rather than sweeping adjustments.

Both brands, however, signal the same message: luxury watch pricing continues to move upward.

We expect to see many more cheap clone Rolex watches collectors choosing to buy on the secondary market rather than at retail, where costs for certain models will be much more attractive to buyers.

What This Means for Rolex Collectors

Historically, higher prices have not dampened demand for luxury high quality Rolex replica watches, and this is unlikely to change.

Buyers purchasing at retail are unlikely to be deterred by rising prices as previous increases have done little to shorten Rolex’s famously long waitlists.

Soon you can expect to see pre-owned Rolex and AP values rise, since the secondary market will eventually have to match retail pricing.

For serious collectors, buying your Rolex or AP on the secondary market may become the most desirable way to shop. Many gold models are already below retail on the secondary market, and we expect to see this gap widen even further!

However, existing stock purchased pre-price hike might not be quite as affected.

If you’ve been considering a Rolex or AP purchase but haven’t yet committed, now may be the moment to act. Retail prices will inevitably cause a sweeping rise in prices on the secondary market, and buying your best selling Rolex fake watches before this market change goes into effect might be the way to go.

Rolex has rarely reversed price increases in the past, meaning collectors should prepare to see these higher price tags become the new normal.